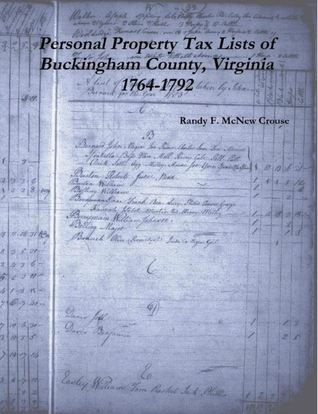

Download Personal Property Tax Lists of Buckingham County, Virginia 1764-1792 - Randy F. McNew Crouse file in ePub

Related searches:

When buying real estate property, do not assume property taxes will remain the same. A change in ownership may reset the assessed value of the property to full.

Situations it may be convenient for both the taxpayer and the county assessor to list leasehold improvements on the personal property tax roll.

Lists give name of person taxed or tithed, type and amount of taxable property, amount of tax, and the county statistics. Most years contain two lists per year since the county was divided into two districts. Some years have the lists bound in one volume while other years have the lists bound separately.

Tax-free exchange of rental property occasionally used for personal purposes. If you meet certain qualifying use standards, you may qualify for a tax-free exchange (a like-kind or section 1031 exchange) of one piece of rental property you own for a similar piece of rental property, even if you have used the rental property for personal purposes.

To view tax bills, make an online payment, or print a receipt: view and pay to list business personal property: to list business personal.

The following items are considered taxable personal property in north carolina and are required to be listed by the owner and are subject to tax based on their january 1st value. Property tax rates are based on the physical location of the property. (boats, aircraft, mobile homes, unregistered vehicles/motorcycles, trailers, campers and rvs).

Personal property tax relief, (pptr) gives tax relief on the taxes due for the first $20,000 in assessed value on qualified personal vehicles.

While the list of personal property subject to taxation varies by state, common items not subject to personal property taxes include: intangible personal property – shares of stock, bones, notes, money at interest, business records, patents, trademarks, computer software, designs and surveys.

Virginia tax code requires all business owners, including home-based businesses, to file a business tangible personal property return and current asset list.

Personal property tax lists of buckingham county, virginia 1764-1792 book. Read 2 reviews from the world's largest community for readers.

The department collects or processes individual income tax, fiduciary tax, estate tax returns, and property tax credit claims.

It is assessed tax separately from real estate, but is taxed at the same rate.

If you file your tpp return by april 1, you will be eligible for a property tax exemption of up to $25,000 of assessed value.

A few notes about the personal property tax lists: the numbers following the names on the lists are the numbers of white tithable persons in the household.

74% of a property's assesed fair market value as property tax per year. California has one of the highest average property tax rates in the country, with only nine states levying higher property taxes.

The assessor sends out assessment lists at the end of each year. It is your responsibility to return that list to the assessor's office by march 1, listing the taxable.

The personal property department collects taxes on all motorized vehicles, boats, recreational vehicles, and motorcycles. The value of your personal property is assessed by the assessor's office. These tax bills are mailed to citizens in november and taxes are due by december 31st of each year.

The code of virginia requires all business owners, including home based businesses, to annually report business tangible personal property for taxation.

Visit the oregon department of revenue's website for more information about business personal property taxes.

Default description having a rental property means you get to take advantage of the many tax write-offs available. These rental property tax deduction books will help you learn everything you need to know.

Personal property taxes businesses on the grand list of october 1st of each year will pay taxes the following july.

The assessor is responsible for the equitable distribution of the tax load through the assessed valuation of real estate, buildings thereon and personal property.

Also, if it is a combination bill, please include both the personal property tax amount and vlf amount as a grand total for each tax account number. By mail payment may be made by check, certified check or money order and sent to one of the addresses below.

A form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts and corporations that own or hold personal property on january 1st unless expressly exempt. A form of list must be filed by march 1st with the board of assessors unless an extension is granted.

What does millage rate mean and how is it calculated? what credits are available and how do i get them? what happens if i get a tax lien certificate?.

If you're a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. A tax appraisal influences the amount of your property taxes.

Does shenandoah county publish a delinquent tax list? delinquent real estate and personal property tax lists are periodically posted on the treasurers.

What is the personal property tax relief act? the personal property tax relief act of 1998, as revised in 2004 and 2005, provides tax relief for passenger cars, motorcycles, and pickup or panel trucks having a registered gross weight of less than 7,501 pounds.

Taxes not paid in full on or before december 31 will accrue interest, penalties and fees. Taxes are assessed on personal property owned on january 1 but taxes are not billed until november of the same year. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from jackson county.

§ 77-1804 the lists of delinquent real property taxes are based on the information as submitted by each county treasurer the first week of february. The nebraska department of revenue's (dor's) list will be updated each february.

Tax increment financing video library the division of property taxation coordinates and administers the implementation of property tax law throughout the state and operates under the leadership of the property tax administrator, who is appointed by the state board of equalization (state board).

North carolina general statute (105-308) requires that all persons owning property that is subject to taxation must list this property annually within the regular listing period of january 1 through january 31, with the exception of registered vehicles.

Welcome to the madison county, alabama online tax record search. This search engine will return property tax information of record in madison county. The information is uploaded to this server frequently but may lag behind actual activity at the courthouse.

The tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate, and is generally an obligation of the owner of the property. Values are determined by local officials, and may be disputed by property owners.

If you own a vehicle or trailer, you must also pay a yearly license fee, which is automatically added to your june 25th tax bill. Following the virginia code, items of personal property are valued by means of a recognized pricing guide using the january 1st value of the assessment year or percentage of original cost. Below, you will find the guides used for the assessment of various types of personal property.

Delinquent personal property tax bills are white in color with pink boxes, and are mailed out in the beginning of august. This is not a new bill, this is a second notification of taxes due, and it includes penalty and interest, as well as any delinquent taxes due for prior billing periods.

All personal property other than real property, including, but not limited to: business equipment, office machinery, inventory, furniture and fixtures not located at the owner's domicile and situated in massachusetts is taxable unless expressly exempt. There are many exemptions, which are usually based on (1) ownership, (2) type of property, or (3) use of property.

Tangible personal property tax is an ad valorem tax assessed according to the value of assets such as furniture, fixtures, and equipment located in businesses or rental properties. The property appraiser assesses the value of tangible personal property on january 1st of each tax year.

The personal property owner should list his or her personal property with the correct county during the regular listing period in january. Extensions for listing personal property may be granted by the county assessor up to april 15 (or june 1 for counties with electronic listing) upon a timely request.

One good solution is to use a separate document, usually called a “personal property memorandum,” in addition to your will. All you have to do is make a list of items and the people you want to inherit them, and sign it—bingo, you’ve got a personal property memorandum.

The business personal property unit is responsible for the valuation of taxable personal property owned by business entities throughout the state of maryland. To receive important reminders from the department join our personal property list serve, by clicking this link.

Individuals can deduct personal property taxes paid during the year as an itemized deduction on schedule a of their federal tax returns, at least up to a point. This deduction was unlimited until the tax cuts and jobs act (tcja) imposed an annual cap of $10,000 effective tax year 2018.

) failure to list all tpp property on the return will result in a penalty of 15 percent of the tax attributable to the omitted property. ) where can i find more information? see property tax oversight’s list of faqs or contact us at dorpto@floridarevenue.

The amount you owe in property taxes is fairly easy to calculate. You’ll just need some information: the assessed value of the home; the property tax percentage for your area; for example, if you’re in a county that charges a 1% property tax and your home and land are valued at $100,000, you would owe $1,000 in taxes.

Personal property tables contain the industry category, cost factor, economic life estimates, general percent good and level of value factor tables that are provided to assist county assessors and other users in valuing personal property by application of the cost approach.

Beginning in 2018, deductions for state and local taxes, including personal property taxes, are capped at $10,000 per tax return. Prior to 2018, there is not a cap for these deductions, although large amounts of these deductions can cause you to be subject to the alternative minimum tax and therefor offset a large deduction.

Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well. Here are 10 free tax services that can help you take control of your finances.

The sweeping tax legislation of 1781 defined two set of tax lists, personal property, and land tax, and required that a copy of each list be forwarded to the state government; consequently both types lists.

18 mar 2021 taxability of tangible personal property and services.

Personal property tax lists include more names than land tax lists, because they caught more of the population. These records identify white males over 21 years of age and include references to real estate holdings, personal property, slaveholdings, and inheritances.

Loudoun county collects personal property taxes on automobiles, motorcycles, trucks, boats, campers, mobile homes, trailers, and aircraft. A vehicle has situs for taxation in the county, or if it is registered to a county address with the virginia department of motor vehicles.

A property tax is a municipal tax levied by counties, cities, or special tax districts on most types of real estate - including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.

Deadline - charge-back delinquent personal property taxes (sec. ) deadline - state board of assessors notify municipalities of prior year manufacturing assessment objection determinations (sec.

Publication 545: personal property: this publication answers common questions about arizona property taxes on personal property that is valued by the county assessor. Publication 546: residential property: this brochure explains how assessors in arizona use computerized systems to value single family residential property for property tax purposes.

After that date, the full amount of personal property taxes are due plus interest. Full unpaid personal property taxes are sent to the sheriff for collection in march. If the first half taxes are paid in december, the second half is due on or before may 10th.

The following list describes some of the personal property exempt from taxation: any stand-alone item purchased after january 1, 2013, with a total acquisition and installation cost of $3,000 or less.

Title: the personal property tax lists for the year 1787 for rockingham county, virginia.

If you’re thinking about moving to a new state, you probably want to check out a few details first: what the housing market’s like, how many jobs are available and, of course, how much you’ll pay in property taxes.

04 tax list and duplicate of delinquent personal and classified property taxes - publication - notice of lien - certificate of jeopardy - stay of collection.

There’s so much more you can do with it than you can do with a rental. You can own pets, renovate, mount things to the wall, paint and make many other decisions and changes.

By state law, the county assessor is responsible for the assessment of real and personal property, including the calculation of taxes.

Post Your Comments: